Build Alpha: Basic video explaining and testing Moving Average Convergence Divergence (MACD) on some popular Exchange Traded Funds (ETFs) such as: SPY, QQQ, TLT, GLD and more.

Wednesday, 2 September 2020

Tuesday, 2 June 2020

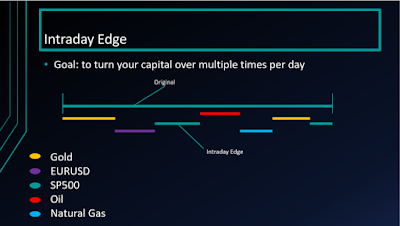

Intraday Edge: Find strategies backwards

A large

consideration of developing trading systems should be how efficient our

capital is working for us. The quicker we can realize profits, the more

trades we can make thus allowing our capital to compound more quickly.

Additionally, sitting in positions for long periods increases our risk

to extraneous events.

More

importantly, it is typically easier to find daily or higher timeframe

edges than intraday edges due to the increased noise in intraday data.

Is there a way

to reduce the time in a position which would increase our trade count

(via number of strategies) which would then allow us to arrive at the

law of large numbers more quickly and therefore allow our capital to

compound more quickly?

Yep. One of the new features in Build Alpha,

called “Intraday Edge”, is a tool which allows us to do exactly that.

It allows us to dig deeper into daily trading strategies to see if we

can make them more efficient by reducing their holding times into

smaller intraday time windows. Maybe we can capture most of the daily strategy’s edge during only a small portion of the typical holding time. That’s right.. turning daily strategies into intraday strategies.

A simple example can help clarify the power of this new feature…

First, let’s

take an original daily trading system. I will use a simple one rule

strategy that goes long the SP500 futures contract whenever the trading

session closes in the bottom 20% of the day’s range (internal bar

strength or internal bar rank – IBR in Build Alpha). We then hold that

long position for 1 day. This assumes about a 23 hour risk (i.e., one

Globex trading session).

However, what

if we could dig into this strategy and realize that most of the gains

only come from 1 am EST to 4 am EST? We can then reduce our holding time

by about 87% which now only ties up our capital for 3 hours as opposed

to 23! This gives us an additional 20 hours to utilize other strategies

to continue to grow our capital while still capturing a large portion of

the original daily strategy’s edge.

Imagine we

only had enough capital for one strategy. This Intraday Edge feature can

now make our capital work much harder by finding intraday edge

strategies for multiple markets/times of the day. Tying up capital for

23 hours in one daily strategy vs. trading 7 different intraday edge

strategies with the same capital.

*Original strategy can be

reduced by Intraday Edge which allows other intraday strategies to be

traded with the same capital that was orignially tied up by the daily

strategy*

In the end, it makes our once daily

system much more efficient. Check out the performance metrics of the

original daily system compared to the new “Intraday Edge” version.

- Highlight any daily strategy

- Click the Test Settings in the bottom right to configure the intraday timeframe you want to use

- Hit the Intraday Edge button

BuildAlpha

will then search all possible holding periods within the original

strategy’s trading duration to see if there is a more efficient version

with reduced holding times. You can include the original strategy’s exit

criteria such as stops, etc. or choose to exclude them. Flexibility to

test everything is always key in Build Alpha.

Intraday Edge can even be used on

different markets at the same time. For example, imagine an original

system built on Gold daily bars but then we search for an intraday edge

version that trades oil but only during this specific 2 hour window

while the original Gold System has an active signal.

This Intraday Edge feature essentially

allows us to search for intraday and multi-timeframe strategies in a new

way. In this above Gold and Oil example we have a multi-timeframe AND

intermarket strategy created from a simple Gold daily strategy.

You can still search for multi-timeframe

and intraday strategies in the original/traditional way. That is, just

searching the intraday data from the start. However, it is often faster

and easier to find daily strategies then work them into intraday ones.

At least now with Build Alpha you have the option to search both ways. Something not possible elsewhere.

And of course, all of the adjustments

from the Intraday Edge feature are then applied to the code generators

so you can automate these Intraday Edge systems with one click as with

everything.

As always, I will keep attempting to add

flexibility and ways to dig deeper so we can have the best trading

strategies possible. Leave no stone unturned and test everything!

Thanks for reading,

David

Noise Test Parameter Optimization

In short, this

is a new feature that allows us to optimize strategies across noise

adjusted data series as opposed to the traditional method of

optimization which only optimizes across the single historical price

series.

The problem we face is the historical data is merely only one possible path of what *could* have happened. We need to prepare ourselves for the probable future not the certain past. In

order to do this, we can generate synthetic price series that have

altered amounts of noise/volatility than the actual historical data.

This provides us with a rough sample of some alternate realities and

potentially what can happen going forward. This is the exact type of

data that can help us build more robust strategies that can succeed

across whatever the market throws at us – which is our end goal in all

of this, right?

Let’s look at a Noise Test Parameter Optimization (NTO) case study to show exactly how it works…

I have built a strategy from 2004 to 2016 that does quite well. The strategy’s performance over this period is shown below…

Now, if we

right click on the strategy and select optimize, we can generate a

sensitivity graph that shows how our strategy performs as we alter some

parameters. This is done on the original historical price data with no

noise adjusted data sample added (yet). We simply retrade different

variations of parameter settings on the single historical price data and

plot the respective performances. This is how most platforms allow you

to optimize parameters and I want to show how misleading it can be to

traders. The rule I’ve optimized had original parameter values of X = 9

and Y = 4 (black arrow). The sensitivity graph is shown below. Each plot

consists of three points: parameter 1, parameter 2 and the resulting

profit.

Build Alpha:

We can see the original parameters are near a sensitive area on the

surface where performance degrades in the surrounding areas. Performance

drops pretty hard near our original strategy’s parameters which means

slight alterations to the future price data’s characteristics can

degrade our strategy’s performance quite a bit. Not what we want at all

and, as we all know, there will be alterations to future price’s

characteristics! How many times has a backtest not matched live results?

Perhaps more robust parameter selection can help

The more

robust selection using the typical simple optimization method on the

historical data shows we should probably pick a parameter more near X = 8

and Y = 8 (pictured arrow below). This is the traditional method taught

in textbooks, trading blogs, etc. We optimize on the single historical

data then find a flat/non-peaked area close to our original parameters

and use those new parameters.

However, if we run BuildAlpha’s

Noise Test Optimization with up to 50% noise alterations and 50 data

samples (green box below), we see a much different picture. What this

does is, instead of optimizing on one historical path we now optimize

across the one historical path AND 50 noise altered data series. The

sensitivity graph shows a much different picture when optimized across

the 51 data series. We are less concerned with the total profit and loss

but rather the shape of the surface…

Originally Posted: http://buildalpha.com/noise-test-parameter-optimization

Originally Posted: http://buildalpha.com/noise-test-parameter-optimization

Friday, 15 May 2020

Make Task Investing Easy

Investment in

stocks in such a volatile market nowadays has become a cause of concern

and how to manage one’s finances. Most of the people ask their fund

managers to invest in quality stocks at this point in time. Which is the

best asset class to invest in and how to manage your portfolio? Some

people think that investment is the most straightforward aspect of

financial planning, whereas nobody knows the correct answer and is

debatable. But now, with the advancement of technology, things have

become quite more comfortable and if we look at the broader pictures

with investing tools like Build Alpha, it is far easier to invest and trade with the best expertise available with you at every point of time.

Investment in

the capital markets can be comparatively easier than other asset classes

or yield drivers. One should invest smartly and systematically keeping

in view the returns on your investment, but most of the investors do it

otherwise, and everything is turned around like not placing the

upside-down cake correctly, thus the toppings at the bottom scatters.

With a tool like Build Alpha now investing activity has become way

easier as it gives proper analysis of the trend of the market.

Especially for

the new age investors who have just entered the market, they can

quickly get the knowledge in the simplified version through this unique

tool. It is very user friendly and an easy to access tool that serves

just perfect for solving the queries and dilemmas of new as well the

experienced traders and investors. Even if you are dealing in the market

for long-term, there ought to be something or the other that may bother

you or you may not understand as the market is quite volatile and it is

quite difficult to depict the pattern well.

Here is where BuildAlpha

comes into play by helping you out with that uncertain motions of the

market where you fear to take your next steps. As with unpredicted

levels and economic uncertainty of course comes a lot of risks. Build

Alpha can help you identify these risks to hopefully sidestep them

before they affect your portfolio.

Very well

written by Warren Buffet, there are lots of ups and downs in the stock

market, and one should be patient. That is why he termed the capital

market where investing is a no-called-strike game. So now, with this

unique and very useful tool, it has become much simpler to invest in the

capital markets and earn money, and the same time the fear of losing

will be minimized as now you have experienced moves, tested them and are

ready for the next one. Therefore, do the research of the markets with

the help of Build Alpha before you are interested in investing and before new risks hit the market.

Originally Posted: http://buildalpha.us/make-task-investing-easy/

Friday, 8 May 2020

Volatility Filters Into Stock Market Decline

The recent volatility, like all volatility events, has brought some traders a fortune and others pain.

The ability to identify volatility regimes is paramount!

Correct

identification of volatility shifts gives one the ability to adjust

size, turn strategies off, enable hedging strategies, etc.

Ideally, a

trader should have strategies for every market regime. If one can

identify which regime and price action characteristics are likely (or

unlikely) then plenty of stress can be removed and a certain level of

robustness is added to the trader’s portfolio.

In this post, I

want to discuss four ‘volatility identifiers’ that can hopefully be

used to either avoid or capitalize on the next volatility event.

These have been powerful indicators to add to trading systems to help decide when on/off, filtering and of course sizing.

Are they a be all end all? No.

Are they predictive? No.

Are they a holy grail? No.

Should you ignore them? No!

I will only

examine these volatility regimes based upon tomorrow’s range and

tomorrow’s return.

They can of course be expanded to look at 5 days

forward, 20 days forward, etc. but this is left up to the reader.

Plotted below

is how these volatility identifiers affect the S&P 500’s next day

range and return. The X-axis is the volatility identifier and the Y Axis

is the S&P 500 range (or return) for the next day.

BuildAlpha:

In short, the level of these volatility identifiers has a BIG impact on

what you can expect for tomorrow’s session and thus your trading

systems can/should take a look to see if these can help improve

performance or even alert to when some strategies should be ‘offline’!

1)

Treasury Spreads vs. S&P 500 Futures. When the 10-year yield minus

the 2-year yield is too flat or too steep things tend to get

volatile. The x-axis is the basis points of this spread. This is the

only goldilocks identifier in this post where volatility increases at

both extremes of this indicator but mellows out in the middle of the

range.

2)

Whenever the front month VIX futures contract is trading above the

second nearest month by more than 5-10% things tend to get volatile.

Here is the VIX futures curve in March of 2019 vs. March 2020 as well as

the contango percent.

3)

Whenever SPX index’s option gamma exposure (GEX) is negative things

tend to be more volatile. Gamma exposure is the total sum of gamma

(option greek) multiplied by open interest of the calls minus the sum of

gamma multiplied by the open interest of the puts. This gives us a

sense of where/how option market makers are positioned. When GEX is

negative things tend to get volatile.

4)

Whenever the S&P 500 components’ gamma exposure is negative things

tend to be more volatile as well. Obviously very correlated to #3 but

important to note the distinction. This is like above but is the

aggregate of the actual options on the ~500 stocks in the index vs. the

options on the index itself.

There are

other volatility identifiers such as Dark Pool Index (DIX), counting the

number of S&P 500 stocks above/below the 50 day moving average,

number of new highs vs. new lows, economic data filters, etc.

Also, to be fair, Gamma Exposure and Dark Pool Index were first published here: https://squeezemetrics.com/download/white_paper.pdf and pointed out to me by a bunch of Build Alpha users. I want to give credit to where it is due.

In the latest Build Alpha update

all of these volatility identifiers, economic data and market breadth

filters will be included and testable at the click of a button. Even

possible to automate them as part of your strategies built and/or

improved by Build Alpha.

I am looking forward to a post COVID world

and what the market will bring us on the other side. Be prepared! Any

questions please contact me at david@buildalpha.com

Tuesday, 5 May 2020

Build Alpha Update

Build Alpha: In the latest update it is now easier than ever to modify the built-in signals, optimize parameters across noise adjusted data series and other symbols, create rebalance strategies, search for intraday edges and new signals including Gamma Exposure, Dark Pool Index and more.

Tuesday, 7 April 2020

Ideal Investing Tool

Trading and Investing is not an easy job and it is

best if you have an expert’s advice or better yet a true quantified

edge. To gather expert advice and quantified edge, there is a unique

tool on the market which is designed specifically for trading and

investing purposes. It will serve the purpose for the new investors, and

for the existing ones who are experienced in providing them with expert

advice, new methods of testing and validation. Build Alpha is the ideal software that will help you creating a trading or investing plan that experts would be proud of.

With this best investing tool, you inevitably live in

the golden age of stock market investing. You will get unlimited

information, which everyone can reach who is using the software. Build

Alpha provides unparalleled data, signals and testing methods to help

you build the best trading or investing strategies. It is such a unique

tool which will help you in many ways.

It is very economical and is of great tool which

small investors are taking great advantage of. These small investors

spend next to nothing for tools, the best investing tools, and

knowledge. If you’re someone who is invested in the stock market, you

should surely look at BuildAlpha. It can even help you analyze your existing trading or investing strategies as well as help you create new ones.

Features of Build Alpha Investing Tool

1. The first advantage that you get from this tool, Build Alpha

is the ability to test thousands of trading and investment signals

without having to write any code yourself. You can select from

candlestick patterns, technical indicators, volume, market breadth

studies, intermarket signals, multi-timeframe signals and much more to

test, create and build your perfect investment strategy – all is done

point and click with no programming. This gives the trader and investor a

significant advantage because of the amount of time saved.

2. Free Portfolio Analysis – Another

feature that you should check for is the portfolio analysis or

Portfolio Mode. With the help of Build Alpha, all the aspiring investors

can analyze their portfolios for prospect and opportunity. This

portfolio analysis tool will not cost a lot of money and will give you a

lot of investing tools and tests you can use. It will offer you

tremendous robust analysis tools. These tools possess a piece of expert

advice which actually feels like it contains various experts. The tools

also allow you to run simulations, find efficient quantitative test and

factor-based financing models.

Individual stock investors can use this software for

to find the best portfolio for their risk return desires. Investors can

track trades, calculate risk-adjusted revenues, and conduct quantitative

research. It will also assist you in maintaining your portfolio as a

whole rather than just your individual strategies and positions.

3. Education of Investors

To compete in today’s market, traders and investors

need proper tools and education. Build Alpha comes complete with private

training video course to assist new and advanced traders and investors

on how to properly build strategies, test them and construct proper

portfolios for individual risk/reward characteristics. This is an all in

one tool that comes complete with training. This gives Build Alpha users significant advantage over their counterparts still attempting to learn and build strategies manually.

Originally Posted: http://buildalpha.us/ideal-investing-tool/

Thursday, 5 March 2020

Insights of Trading

Trading is not as easy as we think it

is, it requires years of experience or proper expert advice. Most of us

do not have years we can sacrifice to learn the markets and all that is

required to be successful. In that case, it is necessary to find some

expert advice or something equivalent to expert advice to assist in your

decision making. This is especially true for investors who are

investing in the market for the very first time. They need to step in

the stock market with prudence and care as they are new traders with

limited knowledge competing against some of the top sharks in the world.

On the flip side, there are so many experts that it is hard to know

which expert to trust and listen to as half of them are right and half

of them might not really be experts at all.

To replace this confusion and need for an external investor, new software like Build Alpha

can help. This software makes trading and investing about the data and

finding the right data to support your investment ideas. If the data

does not agree with your idea, then you should not act. One thing which

should be in your mind while investing is to avoid greed and do not have

fear while investing. Make a portfolio from various sectors, asset

classes and countries. Researching your own data and constructing your

own portfolio using powerful software like Build Alpha is proving to be

the most trustworthy resolution in today’s complicated markets.

Talking about potential new investors,

they are always in for those assets which have moderate valuations or

big risk and reward characteristics. Different market analysts have

their investment strategies owing to the Bull and Bear phase of the

market. There are many loopholes for the ones who are trading for the

first time in the market. This is a beginning as well as continuous

guidance to explore, learn and succeed in the trading market.

There is no one that can independently

know all the things in the market as it is a very vast dynamic area, but

with the aid of human-made knowledge and powerful software like BuildAlpha,

one can lead the scale of success as they have the guidance of more

than one expert. You will discover a lot of innovative things about

trading. The tool is an overall solution to guide you on the right track

in the trading. To seek the answers in which you need and can trust.

So why are these trading tools becoming so important?

The first aspect is in the fact that

these trading tools are the simplest way to conduct proper research and

test ideas to compete with professional investors and hedge funds. Build

Alpha works on any market cycle, interest rate environment,

inflationary or deflationary economy and market trends or chop. It is

important to devise a trading plan for all the different scenarios and

having a tool that can test for this is paramount to both individual and

professional success. Now we have just evened the playing field.

Next up is the need for diversification,

which requires in-depth studies of correlations, different markets and

how they interact. How will you construct a portfolio of diverse assets

and strategies? Do you have a means for testing this portfolio in the

different market cycles? This is the void Build Alpha

can fill in your process to lead you to your desired result. Please do

not trade or invest without data and proper testing, especially now that

it is so easily possible!

Originally Posted: http://buildalpha.us/insights-of-trading/

Monday, 17 February 2020

Why Are Expert Analysis Tool Vital In Stock Market ?

One should invest in the right manner to

get the appropriate return nowadays. A lot of hard work is put in to

earn and in achieving your goals, which may not be sufficient for

leading a comfortable lifestyle. In order to fulfill your dreams, the

investment should be made appropriately to make your money work hard.

Money lying in your bank is not earning anything, so you must trade or

invest your money smartly to earn a return.

Investing in an equity market, one must

have the proper knowledge of its technical as well as fundamental

analysis. Both technical and fundamental analysis will tell you some

about the movement of different stocks but how can you be sure?

Quantitative analysis can be the missing piece. That is, using

historical data and statistics to find the best opportunities.

This enables you to better decide on entering and exiting from the market. BuildAlpha

is devised to help in making your investment decisions. Technical

analysts tell you the movement of the prices of the various stocks and

seemingly guess when to buy or sell a stock. But it is not always

possible to take the support of human “experts” all day long, but now

with the help of this analytical software, it has become possible. The

software does not comprise a single expert knowledge but knowledge of

various experts (that is, the historical data).

Types of Analysis by Software

Software, like Build Alpha,

are best suited to serve the quantitative analysis, stock screening,

and thereby provide the right base to start strong in the market,

especially for someone new to the market. Once the investor sets a

tracking portfolio of corporations (or commodities or forex), then the

analysis tools become valuable. Once the investor has created the group,

portfolio tools will present all the right techniques to achieve these

funds efficiently, thereby helping you succeed in the complex stock

market easily as the analysis tool helps in drawing out expert

assumptions by drawing in various price patterns. Also, for technical

analysis, they offer an excellent and interactive charting platform for

clearing up your queries. An investor can quickly get to know about

which indicators and moving averages work best on a particular market

and can customize these to meet their desired plan.

Primary Functioning Of the Expert Tools

The primary function of Build Alpha

is to allow the trader and investor the ability to find what price

patterns, fundamental analysis and indicators work best in providing the

best risk return. There are many advanced statistical tests like Monte

Carlo simulations and noise testing that help the trader and investor

decide if an investment strategy is robust and will likely show similar

returns moving forward. This is the key to any solid investment strategy

– not how it has done historically but how we expect it to perform

going forward. Without being able to determine this then one is destined

for failure.

Originally Posted: http://buildalpha.us/expert-analysis-tool-vital-stock-market/

Monday, 3 February 2020

What is need for Trading Software?

Trading is one of the most popular

activities in which people are doing these days to earn money, start a

new career or even just supplement their income. Some even consider

trading and investing a passive source of income – which of course

requires some knowledge of the market. For someone who has already been

trading and trying their luck, it can still be better to keep pushing

forward without help. But for someone new to the trading market or the

struggling trader, that person surely needs additional help to trade the

right way.

Finally, there is a software to assist. A tool like a Build Alpha

can help them facilitate trading ideas and better understand the

financial outcomes, such as risk and reward, drawdown, position-sizing,

etc. It can also be used on any market type such as futures, stocks,

currencies, bonds and even cryptocurrencies. Dealing in all these

markets as a primary market or secondary market is made easier with the

help of software. Comparing the same with the other options like taking

the help of gurus or trading ‘experts’ leads to massive misinformation,

account loss, and brokerage cost. These firms and ‘educators’ present

their buyers with buying ideas that have not been tested or on the

behalf of other clients that want to take the other side.

Software like Build Alpha

that helps in trading is quite accessible as it can be easily

downloaded and launched from a desktop or portable device. There is no

skill required to operate it as the software can take any user input and

return satisfactory results for trading and investing decision making.

So Why are these trading tools Vital

Let’s see the following essential points of these trading tools:Trading software helps in facilitating buying and examination of financial outcomes.

It helps the traders that are trading

alone, which is the self-directed trader. They require to employ and

discover how to efficiently manage their trading software in enhancement

to learning how to buy or invest.

Many other General characteristics of these

trading tools incorporate order arrangement, technical review,

structural analysis, electronic trading, and journal trading. So there

is a lot on your plate that is served with this single tool.

Comprehension of This Trading Tool

These trading tools like BuildAlpha

are giving the right set of insight to the traders to deal in the

security market. Many of the traders and investors these days have

shifted towards making at least some of the trading and interpretation

utilizing the self-directed trading accounts. This is the main reason

that there is an increase in the demand for such software that will

provide the right trading capabilities — also giving a thorough analysis

and knowledge resources within the software.

This software can give users the right

pricing information for assets, fundamental data, graphs, functional

analysis, vital statistics, some basic chat rooms, and many other

features that are vital from the investment point of view. You will get

the best application programming interfaces, that help service the trading software management. So now you can run independently on their network.

Thursday, 30 January 2020

Improving Strategies

A crazy cool way to use Build Alpha. I have to admit that I did not come up with this idea, but it was suggested to me by a potential Build Alpha user.

He was wondering if Build Alpha could

help come up with some rules of when he should avoid trading his

existing strategy or even when to fade his existing strategy. Heck any

improvement is a plus, right?

**Please note Build Alpha now

accepts data in this format: mm/dd/yyyy, hh:mm, open, high, low, close,

volume, OI. Please refer to buildalpha.com/demo page for adding own

data instructions**

*I say we found one strategy but we

actually found tons that would be an improvement to his original

strategy. Him and I only spoke specifically about one so that’s why in

the video I slip and say we found one strategy. Did not feel like making

a new video to clarify this minor point.*

He had a day trading system and compiled

profit and loss results for that system in the following (Build Alpha

accepted) format. Date, time, open, high, low, close, volume. (*note BuildAlpha now accepts the time column as intraday capabilities are becoming fully operational*).

Below is his sample file. We purposely

left the open (high and low) columns as all 0’s. The close column

contains the end of day p&l from his original strategy.

We then set Build Alpha to have a

maximum one bar holding period and to ONLY enter on the next bar’s open

and to the ONLY exit on the next bar’s close. I will explain why this is

in a minute.

We then chose the underlying symbol the

original strategy was built on as market2. So for example, his original

strategy trades ES (S&P500 Emini futures) so we only select Build

Alpha signals calculated on Market2 which is set for ES.

So now if Build Alpha

calculates a rule on ES-like close[0] <= square root(high[0] *

low[0]) then we would “buy” the next bar’s open of market1 (again his

results – which are 0) and “sell” the next bar’s close of his results

which is the original strategy’s p&l for that day. This would

essentially say that if this rule is true then go ahead with a green

light to trade the original strategy the next day. If the rules are not

true, then don’t trade the original strategy the next day. Ideally, we

can find rules that increase risk-adjusted returns for the original

strategy (which we did).

Now, what is even cooler is if we set Build

Alpha to find short strategies we would essentially be “fading” his

original strategy or finding rules of when to go opposite his original

strategy.

Build Alpha found some good short/

“fade” rules to use as well. Here is an example that did quite well

fading his original strategy (even out of sample – highlighted section).

“There are 2028 negative

periods in my data with a gross loss of -1,217,880.26. That’s the

theoretical maximum a short rule can achieve, if it were to find all

losses. Your graph seems to show 380,000 short rule profits. That’s

already 31% of all losses. If I don’t trade on these days, my net profit

would go up by 380,000, a 46% increase.”

I thought this was a really unique way to use BuildAlpha

and I wanted to share. I think the same analysis can be done on

strategies with longer holding periods too. I would just import daily

marked to market results of the original strategy and Build Alpha would

essentially find rules of when to hedge your strategy or fade it for a

day or two. I think this is certainly a unique approach to add some

alpha to performance.

Anyways, thanks for reading as always and keep a lookout for some MAJOR upgrades coming to Build Alpha very soon!

Originally Posted: http://buildalpha.us/improving-strategies/

Thursday, 23 January 2020

Perks Of Using Trading Software

Stock trading has become a significant

market segment. Every third person is dealing with the same trend. This

segment of the market serves a great set of the potential to make a lot

of money. There are instances where you will observe some of the

wealthiest persons in society have made their estates in stock markets

and investments; they have earned tremendously from this asset class.

However, most do not have a financial

background or business degrees. It is not just their own expertise that

has led them to such success in the market, but it is the assistance of

trading and investment software. Software like Build Alpha

can help guide traders and investors through tricky markets and

identify the biggest trends that lead to wealth accumulation and a

better understanding of the market.

This software Build Alpha,

helps them gain an entire overview. Beginners will be guided on the

underlying trend of the market as well as advanced traders and investors

who can find specific trends for stocks of interest. There are several

thousands of people who are contemplating to make money in the stock

market by analyzing a mixture of approaches. There are also,

unfortunately, many business organizations that create lies, false

narratives and sell misinformed ‘courses’ to naïve investors. Build

Alpha software allows the investor to research the data himself and only

trust the numbers, not some lie a business is selling.

This is the primary cause that stock

trading software has become so popular with investors as the software

can allow investors to execute their trading strategy quickly, based on

facts and systematically. There are several goods of utilizing an

automated trading system or stock investing software to make money in

the stock exchange.

Originally Posted: http://buildalpha.us/perks-of-using-trading-software/

Sunday, 19 January 2020

Forward Simulator and Variance Testing

Build Alpha allows users to simulate how a strategy would perform in the next x trades based on varying win percentages. It uses the back test's distribution to simulate future performance.

Thursday, 2 January 2020

E-Ratio

Edge Ratio or E-Ratio measures how

much a trade goes in your favor vs. how much a trade goes against you.

The x-axis is the number of bars since the trading signal. A higher

y-value signifies more “edge” at that step in time.

BuildAlpha:

Measurements are normalized for volatility; this allows us to use

e-ratio across all markets and regimes. Once normalized for volatility, 1

signifies that we have equal amounts of favorable movement compared to

adverse movement.

In other words, the y-axis is an

expression of how many units of volatility more or against you your

trade gets. A measure of 1.2 would indicate .2 units more of favorable

volatility and a measure of 0.8 would indicate .2 units more of adverse

movement.

Build Alpha:

The blue line is for the selected strategy’s signal and the red line is

for a “random” strategy for the same market. The red line is to serve

as a baseline to beat. Ideally, you’ll want to see a blue line above 1

and above the random line.

Additionally, if E-Ratio falls off a cliff at bar 6… then it probably does not make sense to hold for 15 bars!

Another tool to make sure Build Alpha + Trader = Success.

How to calculate:

- Record Maximum Adverse Excursion and Maximum Favorable Excursion at each time step since signal.

- Normalize MAE and MFE for volatility. To compare across markets we need a common denominator. Let’s use ATR or a unit of volatility.

- Average all MFE and MAE values. Now you should have average MFE and average MAE at 1 bar since signal. Average MFE and average MAE at 2 bars since signal…

- Divide Average MFE by Average MAE at each time step.