A large

consideration of developing trading systems should be how efficient our

capital is working for us. The quicker we can realize profits, the more

trades we can make thus allowing our capital to compound more quickly.

Additionally, sitting in positions for long periods increases our risk

to extraneous events.

More

importantly, it is typically easier to find daily or higher timeframe

edges than intraday edges due to the increased noise in intraday data.

Is there a way

to reduce the time in a position which would increase our trade count

(via number of strategies) which would then allow us to arrive at the

law of large numbers more quickly and therefore allow our capital to

compound more quickly?

Yep. One of the new features in Build Alpha,

called “Intraday Edge”, is a tool which allows us to do exactly that.

It allows us to dig deeper into daily trading strategies to see if we

can make them more efficient by reducing their holding times into

smaller intraday time windows. Maybe we can capture most of the daily strategy’s edge during only a small portion of the typical holding time. That’s right.. turning daily strategies into intraday strategies.

A simple example can help clarify the power of this new feature…

First, let’s

take an original daily trading system. I will use a simple one rule

strategy that goes long the SP500 futures contract whenever the trading

session closes in the bottom 20% of the day’s range (internal bar

strength or internal bar rank – IBR in Build Alpha). We then hold that

long position for 1 day. This assumes about a 23 hour risk (i.e., one

Globex trading session).

However, what

if we could dig into this strategy and realize that most of the gains

only come from 1 am EST to 4 am EST? We can then reduce our holding time

by about 87% which now only ties up our capital for 3 hours as opposed

to 23! This gives us an additional 20 hours to utilize other strategies

to continue to grow our capital while still capturing a large portion of

the original daily strategy’s edge.

Imagine we

only had enough capital for one strategy. This Intraday Edge feature can

now make our capital work much harder by finding intraday edge

strategies for multiple markets/times of the day. Tying up capital for

23 hours in one daily strategy vs. trading 7 different intraday edge

strategies with the same capital.

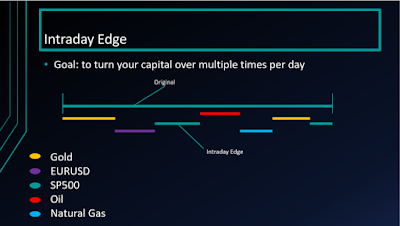

*Original strategy can be

reduced by Intraday Edge which allows other intraday strategies to be

traded with the same capital that was orignially tied up by the daily

strategy*

In the end, it makes our once daily

system much more efficient. Check out the performance metrics of the

original daily system compared to the new “Intraday Edge” version.

- Highlight any daily strategy

- Click the Test Settings in the bottom right to configure the intraday timeframe you want to use

- Hit the Intraday Edge button

BuildAlpha

will then search all possible holding periods within the original

strategy’s trading duration to see if there is a more efficient version

with reduced holding times. You can include the original strategy’s exit

criteria such as stops, etc. or choose to exclude them. Flexibility to

test everything is always key in Build Alpha.

Intraday Edge can even be used on

different markets at the same time. For example, imagine an original

system built on Gold daily bars but then we search for an intraday edge

version that trades oil but only during this specific 2 hour window

while the original Gold System has an active signal.

This Intraday Edge feature essentially

allows us to search for intraday and multi-timeframe strategies in a new

way. In this above Gold and Oil example we have a multi-timeframe AND

intermarket strategy created from a simple Gold daily strategy.

You can still search for multi-timeframe

and intraday strategies in the original/traditional way. That is, just

searching the intraday data from the start. However, it is often faster

and easier to find daily strategies then work them into intraday ones.

At least now with Build Alpha you have the option to search both ways. Something not possible elsewhere.

And of course, all of the adjustments

from the Intraday Edge feature are then applied to the code generators

so you can automate these Intraday Edge systems with one click as with

everything.

As always, I will keep attempting to add

flexibility and ways to dig deeper so we can have the best trading

strategies possible. Leave no stone unturned and test everything!

Thanks for reading,

David